TRREB July 2025 Market Update - With York Region communities

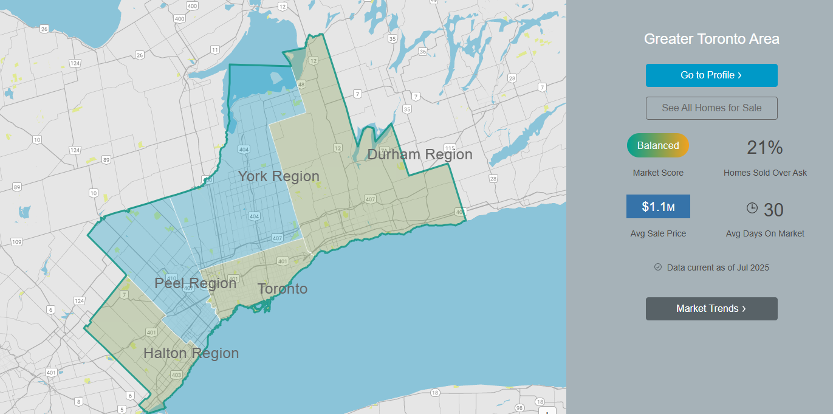

The Toronto Regional Real Estate Board (TRREB) has released its July 2025 Market Watch report, covering the entire TRREB MLS® service area – from the City of Toronto to the surrounding 905 regions, and parts of Simcoe County. This comprehensive overview provides valuable insight into market performance, price trends, and regional highlights across the Greater Toronto Area (GTA).

GTA Overview: Best July Since 2021

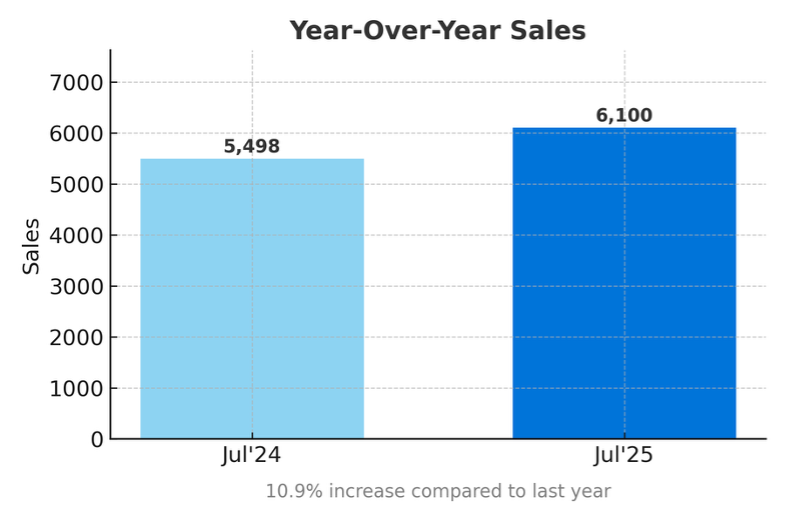

July 2025 marked the strongest July home sales performance since 2021. GTA REALTORS® reported 6,100 home sales, representing a 10.9% increase compared to July 2024. New listings also climbed to 17,613 — a 5.7% increase year-over-year. On a seasonally adjusted basis, month-over-month sales rose 13%, the highest monthly gain in nine months. The pace of sales growth outstripped the rise in listings, resulting in modest market tightening.

Pricing Trends and Affordability

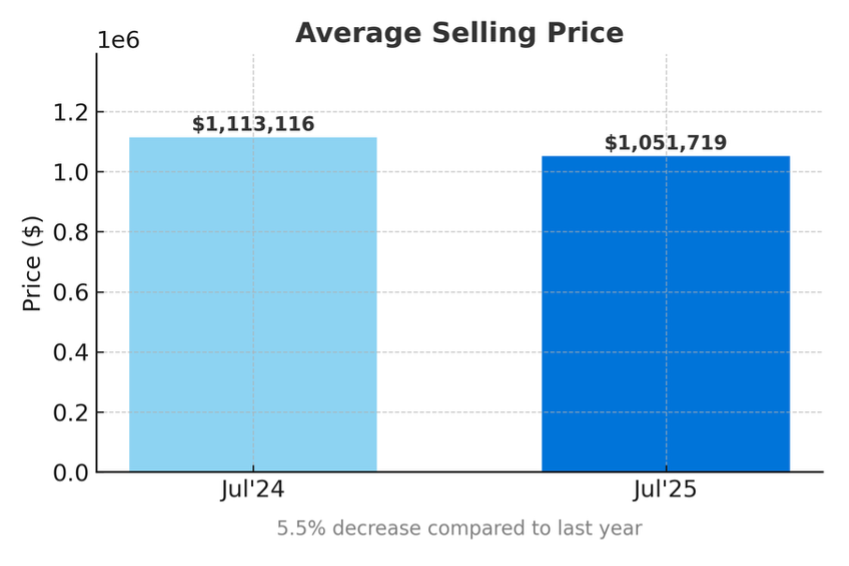

Despite the uptick in activity, prices remained stable month-over-month and lower than last year, helping to improve affordability. The MLS® Home Price Index Composite Benchmark fell by 5.4% year-over-year, while the average selling price across the GTA settled at $1,051,719 — down 5.5% from July 2024. Stable prices compared to June signal a balanced market dynamic amid stronger buyer demand.

Regional Highlights

The TRREB region encompasses diverse market conditions across Toronto, York, Durham, Peel, Halton, and South Simcoe. Key observations include:

Toronto: Strong demand continues for both condos and detached homes, with competitive activity in core urban neighborhoods.

York Region: Median price at $1.11 million, with Richmond Hill and Vaughan leading detached home sales. Market conditions remain cool due to higher inventory levels.

Durham Region: One of the most affordable regions in the GTA, with a median price of $820,000. Detached homes account for the majority of sales.

Peel Region: Median price of $899,000. Mississauga recorded a 14% year-over-year increase in sales, reflecting renewed buyer interest.

Halton Region: Balanced conditions persist, with a median price of $1.05 million. Detached homes remain the dominant housing type.

Simcoe County (TRREB jurisdiction): Continued demand from buyers seeking value and lifestyle outside the core GTA.

York Region Community Breakdown

York Region is a key part of the GTA market, with a mix of urban and suburban communities offering a range of housing options.

Richmond Hill

Market Type: Cool, with high inventory levels (6 months).

Median Sales Price: $1,225,000 (207 sales).

Housing Mix: 54% detached, 27% condos, 14% townhouses.

Most common configuration: 3-bedroom homes.

Price Range: Majority between $1M - $1.5M.

Markham

Market Type: Balanced, with medium inventory levels (5 months).

Median Sales Price: $1,147,500 (270 sales).

Housing Mix: 48% detached, 29% condos, 12% townhouses.

Most common configuration: 4-bedroom homes.

Price Range: Majority between $1M - $1.5M.

Vaughan

Market Type: Cool, with high inventory levels (6 months).

Median Sales Price: $1,160,000 (265 sales).

Housing Mix: 51% detached, 32% condos, 9% townhouses.

Most common configuration: 3-bedroom homes.

Price Range: Majority between $1M - $1.5M.

Aurora

Market Type: Cool, with high inventory levels (8 months).

Median Sales Price: $1,113,500 (46 sales).

Housing Mix: 68% detached, 11% condos, 11% townhouses.

Most common configuration: 3-bedroom homes.

Price Range: Majority between $1M - $1.5M.

Newmarket

Market Type: Balanced, with medium inventory levels (4 months).

Median Sales Price: $925,500 (94 sales).

Housing Mix: 67% detached, 14% semi-detached, 10% condos.

Most common configuration: 3-bedroom homes.

Price Range: Majority between $1M - $1.5M.

East Gwillimbury

Market Type: Cool, with high inventory levels (7 months).

Median Sales Price: $1,100,000 (40 sales).

Housing Mix: 82% detached, 11% townhouses, 7% semi-detached.

Most common configuration: 4-bedroom homes.

Price Range: Majority between $1M - $1.5M.

Whitchurch-Stouffville

Market Type: Balanced, with medium inventory levels (6 months).

Median Sales Price: $1,051,500 (56 sales).

Housing Mix: 73% detached, 12% townhouses, 9% condos.

Most common configuration: 3-bedroom homes.

Price Range: Majority between $1M - $1.5M.

Market Drivers

TRREB President Elechia Barry-Sproule attributes the rebound in sales to improved affordability, supported by stable prices and lower borrowing costs. However, she notes that additional mortgage rate relief will be essential to sustain the current momentum into the fall market.

Outlook

The GTA real estate market enters the latter half of 2025 with renewed optimism. Sales activity is recovering, inventory levels are manageable, and pricing stability is giving buyers confidence. However, varying conditions across sub-markets highlight the importance of localized insights for both buyers and sellers.

Conclusion

July 2025 demonstrates that the GTA real estate market is resilient and dynamic. With sales momentum building and affordability showing signs of improvement, the coming months will be shaped by interest rate policies, seasonal market activity, and regional economic factors.

If you are planning to buy, sell, or invest in the TRREB coverage area, now is the time to align with experienced professionals who can provide accurate data, strategic advice, and strong negotiation skills to help you achieve your real estate goals.